Term Life Insurance: A Quick Guide

Have you ever wondered what term life insurance is all about? Well, wonder no more. This article will give you the low-down on one of the most basic yet important types of life insurance out there. Term life insurance provides coverage for a fixed period, allowing you to protect your loved ones financially in case something unfortunate were to happen to you.

You are probably thinking all this sounds rather morbid. Why would a perfectly healthy person like yourself need life insurance? The truth is, life is unpredictable. Term life insurance gives you peace of mind that your family will be taken care of if you are no longer around.

Stick with us to learn everything you need to know about term life insurance so you can make the choice that’s right for your needs and budget. This quick guide will turn you into an insurance pro in no time. Let’s dive in!

What Is Term Life Insurance?

So, what exactly is term insurance? In short, it’s a type of life insurance policy that provides coverage for a fixed period. A term insurance policy pays out a death benefit to your beneficiaries if you pass away during that term. If you outlive the term, the policy expires and no payout is made.

Term life insurance is a more affordable option compared to whole life insurance or universal life insurance. Premiums are lower because the coverage is temporary. However, term life insurance still serves an important purpose – it provides financial protection for your loved ones if something were to happen to you.

Types of Term Life Insurance Policies in India

There are a few types of term life insurance policies to choose from in India. Let’s break down the options:

• Increasing term life insurance: With this type, your premium and coverage amount increases each year. This helps ensure your loved ones have enough financial protection even as costs of living rise. The increase is usually around 5-10% each year.

• Decreasing term life insurance: Here, your premium remains the same but the coverage amount decreases each year. This is often used to cover a liability that reduces over time, such as a mortgage.

• Convertible term life insurance: This gives you the option to convert your term policy into a permanent life insurance policy, like whole life insurance, without having to provide evidence of insurability. The conversion must happen before the term period ends. This adds flexibility in case your needs change.

As you can see, there are good options for various needs and budgets. Think about your priorities and financial responsibilities to determine the right term life insurance policy for you.

Pros and Cons of Buying a Term Insurance Policy

Pros of Buying Term Life Insurance

- Low cost: Term life insurance is typically the most affordable type of life insurance. Premiums are fixed for the term of the policy.

- Simple: One of the term insurance benefits is that it is easy to understand. You pay premiums for a fixed period. If you pass away during that time, your beneficiaries receive the death benefit. If you live past the term, the policy simply ends.

- Flexible: You can choose the length of the term, typically 10, 15, 20 or 30 years. You can also change the death benefit amount and premiums to suit your needs.

- Tax benefits: The premiums you pay and the death benefits your beneficiaries receive are generally tax-free.

Cons of Buying Term Life Insurance

- Limited coverage: Term life insurance only provides coverage for a specific period. Once the term is over, coverage ends.

- Premiums increase with age: If you want to renew or buy a new term policy, premiums will be higher as you get older.

- No cash value: Term life insurance does not build any cash value. You do not receive any money back at the end of the term. The premiums you pay only provide a death benefit during the coverage period.

As with any type of insurance, term life insurance has both advantages and disadvantages to consider based on your needs and financial situation. Speaking with a licensed insurance agent can help determine if term life insurance is the right choice for you and your loved ones.

Conclusion

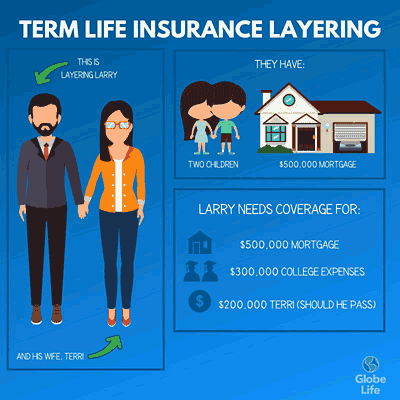

As you have learned, term life insurance is an easy and secure type of coverage that provides financial protection for a fixed period. The premiums are usually quite affordable, and it’s a practical solution if you want coverage for temporary needs like paying off a mortgage or funding your children’s education.

While term life insurance may not build cash value like other types of policies, for many it can provide invaluable peace of mind during life’s most critical stages. Now that you understand the basics, you can explore the options and find a policy that suits your needs and budget. So go forth and use this information to make the best choice for your situation.